Nobody Understands Business Development Like We Do. Period. ™

Mark Marxer is a veteran business builder and capital strategist, featured on the cover of The Top 100 People in Finance in 2023. He is the founded and managing partner of MMX Management and serves as CEO of MMX Sports & Entertainment.

Since founding the MMX platform in 2001 as venture capital company with and global vision, Marxer then patiently waited until the time was right post 2008 to take the next steps building a global growth advisory platform serving entrepreneurs, athletes, institutions, and investors. In 2009, he expanded the firm by hiring additional strategic partners and building specialized verticals—including hedge funds, private equity, real assets, alternatives, venture capital, finance, sports, technology, and entertainment—forming a strategic global network designed to accelerate growth and mitigate risk at scale.

He is also the founder of MMX Global Advisors, a newly launched strategic advisory division focused on strategic planning, management, business development, capital structuring, advanced business planning , and the next generation of global investment opportunities.

In 2024, Marxer launched and now chairs TIGER 21 Boca Raton, one of the country’s most exclusive peer networks for ultra-high-net-worth entrepreneurs and investors. That same year, he was featured on the cover of Top 100 Innovators & Entrepreneurs.

His forthcoming book, Generational Survival (expected 2026), explores legacy leadership, long-term resilience, and the evolving principles of generational wealth preservation.

Earlier in his career, Marxer earned a B.S. in Business from Oregon State University before quickly rising to Director of Marketing at Ameriprise Financial. He later served as Director of Alliance Investments and SVP at AllianceBernstein, CEO of RedSky Partners, CMO of Black River Asset Management, and ultimately as Global Head of Business Development at Citi in New York.

With more than 36 years of experience, he has launched or scaled over 486 businesses and raised more than $23 billion across private equity, venture capital, and hedge fund markets. Today, he remains focused on connecting the world’s top innovators and investors through a platform built on strategic insight, execution, and long-term value creation.

Specialties:

Business Building | Brand Development | Sports & Entertainment | Private Equity | Venture Capital | Hedge Funds | Alternatives | Impact (Wellness, Housing, Education) | AI Infrastructure | Technology | Esports | Wagering | NFTs

Licenses:

Series 7, 14, 24, 63, 65, 79, 99, SIE

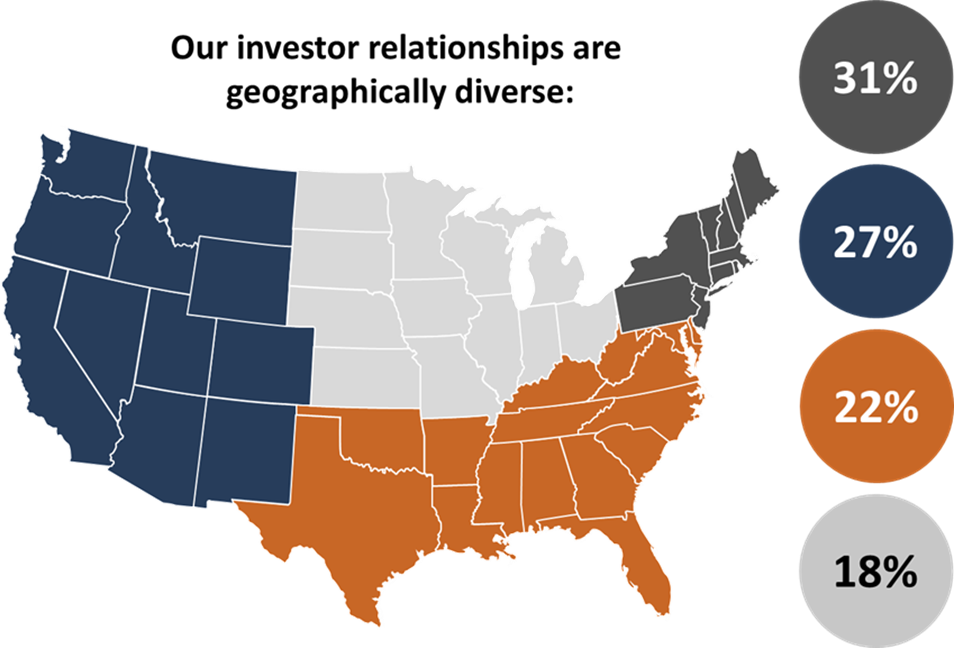

By collaborating with MMX, managers of alternative investments gain access to our wealth of experience, market insights, and extensive reach within the institutional investor community. We assist our clients in diversifying their investor bases, forging relationships with the most suitable institutional investors, and strategically positioning themselves in the market. What sets MMX apart is our customized approach to business development and capital raising. We focus on collaboration, integration, and a specialized strategy for sustainable growth, tailored to each client’s unique needs. Our network, in turn, greatly appreciates the chance to assess, engage with, and grow alongside the top-tier franchises we are helping to build.

MMX’s approach to business building and advisory services stands apart from conventional advisor/fundraising partner options or capital introduction groups you may have encountered. We’ve discovered that the traditional advisor approach may not correlate as strongly with capital raising success as anticipated. This is due to the dynamic, rather than linear, nature of fundraising processes.

Achieving success entails more than just extensive market coverage, breadth, geography, and a high number of meetings. Similar to many investment strategies, effective fundraising is a blend of both bottom-up and top-down approaches, working in tandem to produce the most favorable outcome.

Each firm, fund, team, structure, and investment strategy is unique, initially attracting the attention and interest of a select group of investors. However, the key lies in how effectively a manager presents their strategy, ensuring that investors and clients comprehend the long-term value proposition. Thus, identifying interested investors or partners is less crucial than understanding their decision-making process and thoughts on the prepared materials and preliminary discussions.

A partnership with MMX equips you to assess and prepare for these dialogues, taking into account the anticipated environment and current market interest.